The Zcash community experienced a major shakeup when the Electric Coin Company (ECC), one of the primary development teams behind the privacy-focused cryptocurrency, announced its departure from the project. The split stems from an escalating governance dispute with Bootstrap, the nonprofit organization that oversees Zcash development funding. This dramatic development raises important questions about decentralized governance, organizational structure, and the future of one of crypto’s most prominent privacy coins.

What Happened Between ECC and Bootstrap?

The conflict between Electric Coin Company and Bootstrap didn’t happen overnight. It represents a fundamental disagreement about direction, priorities, and how a cryptocurrency project should be governed.

According to Josh Swihart, CEO of Electric Coin Company, Bootstrap moved into what he described as “clear misalignment” with Zcash’s core mission. In his statement announcing the departure, Swihart didn’t mince words, saying that the Bootstrap board’s actions made it impossible for ECC to work “effectively and with integrity.”

This is significant language from someone who has been deeply involved in Zcash development. When a CEO publicly states that continuing the relationship would compromise integrity, it signals serious underlying issues beyond typical business disagreements.

Swihart emphasized that despite ECC’s departure from working under Bootstrap’s governance, the team isn’t abandoning Zcash. Instead, they’re forming a new company with the same talented developers who have been building Zcash technology. This distinction matters because it means the expertise and institutional knowledge aren’t leaving the ecosystem entirely.

Bootstrap’s Side of the Story

Bootstrap’s board of directors presented a very different interpretation of the conflict. According to their statement, the disagreement centers on compliance and legal issues rather than philosophical differences about Zcash’s mission.

The specific point of contention involves plans for the Zashi wallet, a Zcash-based wallet application. Electric Coin Company reportedly proposed privatizing Zashi through alternative corporate structures. While this might make business sense from a development perspective, Bootstrap saw it as problematic from a legal standpoint.

As a nonprofit organization, Bootstrap operates under specific legal constraints. The board expressed concern that privatizing Zashi could expose the organization to lawsuits from donors who contributed funds expecting them to be used for nonprofit purposes. This isn’t just bureaucratic caution—nonprofits that misuse donated funds can face serious legal consequences.

Bootstrap acknowledged that the proposed Zashi plan might be appropriate from a business development perspective. However, they argued that legal limitations can’t simply be overlooked, even for potentially beneficial initiatives. This represents a classic tension between innovation and compliance that many crypto projects face.

Understanding the Zashi Wallet Dispute

The Zashi wallet sits at the heart of this disagreement. To understand why it became such a contentious issue, you need to know what it represents for Zcash.

Zashi is a user-friendly wallet designed to make Zcash more accessible to everyday users. For a privacy coin, having quality wallet infrastructure is essential because it’s the primary way people interact with the network. A good wallet can drive adoption, while poor wallet experiences push users away.

Electric Coin Company likely saw privatizing Zashi as a way to move faster, attract investment, and build the product without nonprofit restrictions. In the traditional tech world, spinning off successful products into separate companies happens regularly and is often seen as smart business.

However, Bootstrap viewed this differently. If donor funds were used to develop Zashi under a nonprofit structure, converting it to a private, for-profit entity could be seen as improperly benefiting from charitable contributions. This concern reflects real legal risks that nonprofit boards have a fiduciary duty to consider.

The disagreement highlights a broader challenge in crypto: how do you balance decentralized ideals with legal realities? How do you innovate rapidly while respecting the legal frameworks under which organizations operate?

The Zcash Protocol Remains Unaffected

Perhaps the most important message from both sides is that the Zcash protocol itself continues operating normally. This distinction is crucial for understanding what this governance clash actually means.

Zcash is a decentralized network. While development teams like ECC contribute significantly to its advancement, they don’t control the network. Miners, node operators, and users collectively maintain Zcash. The blockchain keeps running regardless of organizational disputes among development teams.

Josh Swihart specifically emphasized this point, reassuring the community that the protocol remains unaffected by ECC’s organizational changes. The core technology, the privacy features that make Zcash valuable, and the network security all continue functioning as designed.

This speaks to the resilience built into well-designed cryptocurrency projects. Unlike centralized systems where internal corporate drama can shut everything down, decentralized networks can weather organizational transitions.

How the Market Reacted

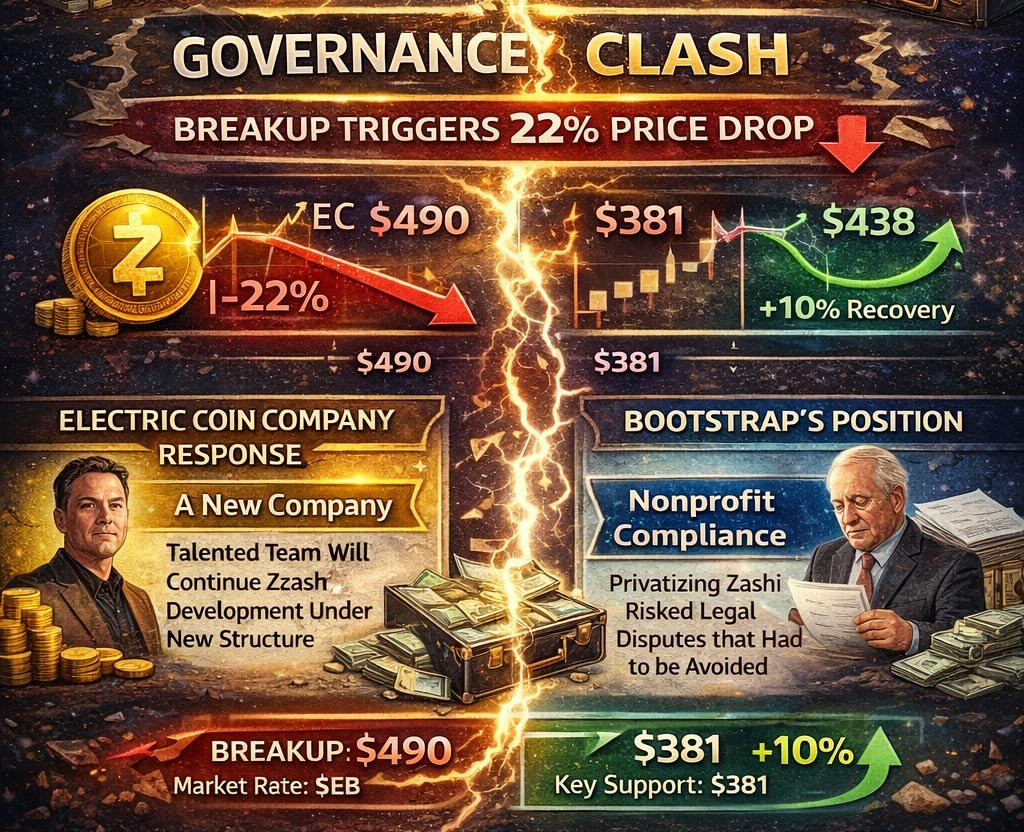

Financial markets often react emotionally to news before fully understanding the details. The initial market response to ECC’s departure announcement demonstrated this perfectly.

When news first broke, ZEC coin prices plummeted by 22%, dropping from $490 to a low of $381. This significant decline reflected investor panic as many interpreted the announcement as core developers completely abandoning Zcash. The fear was understandable—if the main development team walks away, what happens to future improvements and security updates?

However, this interpretation was incorrect. The situation involved an organizational restructuring, not a technological abandonment. Once the market digested the full context and understood that the ECC team would continue working on Zcash through a new company structure, sentiment shifted.

At the time of reporting, ZEC had recovered substantially, rallying 10% to reach $438. The team’s unveiling of new wallet developments and their reaffirmation of long-term commitment to Zcash helped restore confidence. This price recovery suggests the market eventually recognized the difference between a governance dispute and actual project abandonment.

The volatility demonstrates how important clear communication is in cryptocurrency markets. Misunderstandings can trigger significant price movements, affecting everyone holding the asset.

What This Means for Zcash’s Future

The split between ECC and Bootstrap raises legitimate questions about Zcash’s path forward:

Development Coordination

With ECC operating independently of Bootstrap’s governance, how will development efforts be coordinated? Zcash has multiple development teams, but losing tight coordination between the largest team and the funding organization could create inefficiencies.

Funding Considerations

Bootstrap controls significant funding for Zcash development through the network’s built-in funding mechanism. If ECC is no longer working under Bootstrap’s umbrella, how will their ongoing work be funded? Will they seek independent funding sources, or will a new arrangement be negotiated?

Community Governance

This dispute highlights ongoing challenges in crypto governance. How should decentralized projects balance the need for efficient decision-making with the ideals of distributed control? The Zcash community will likely have conversations about governance structures moving forward.

Regulatory Navigation

Bootstrap’s concerns about legal compliance reflect the broader challenge crypto projects face in navigating regulatory frameworks. As the industry matures, these legal considerations become increasingly important, sometimes conflicting with the rapid innovation culture that defined crypto’s early days.

Lessons for the Broader Crypto Industry

The ECC-Bootstrap split offers several insights relevant beyond just Zcash:

Nonprofit Structures Have Limitations

Many crypto projects use nonprofit foundations for governance and funding. While this structure offers certain advantages, it also comes with legal restrictions that can limit operational flexibility. Projects need to carefully consider whether nonprofit structures align with their long-term goals.

Communication is Critical

The initial market panic could have been avoided with clearer initial communication distinguishing between organizational changes and protocol development. Projects facing internal disputes need communication strategies that prevent unnecessary market volatility.

Governance Mechanisms Matter

How projects make decisions and resolve disputes significantly impacts their resilience. Clear governance frameworks that outline dispute resolution processes could help prevent situations like this from escalating to public splits.

Decentralization Provides Resilience

The fact that Zcash continued operating normally throughout this dispute demonstrates the value of true decentralization. Projects that maintain decentralized infrastructure are less vulnerable to organizational drama.

Where Things Stand Now

As the situation continues developing, several things remain clear:

Electric Coin Company’s talented development team hasn’t left the Zcash ecosystem. They’re continuing their work under a new organizational structure that they believe allows them to operate with integrity while advancing Zcash’s mission.

Bootstrap maintains its position as the nonprofit governing body for Zcash, concerned primarily with ensuring compliance with legal and regulatory requirements for nonprofit operations.

The Zcash protocol itself continues operating exactly as designed, with privacy features intact and network security maintained.

The community is watching closely to see how this governance challenge gets resolved and what it means for future development coordination.

The Bottom Line

The Electric Coin Company’s departure from Bootstrap governance represents a significant moment in Zcash’s history, but not necessarily a crisis. It’s a governance dispute between organizations about how to best advance the project while navigating legal realities.

ECC CEO Josh Swihart framed it as a mission alignment issue, arguing that Bootstrap’s direction made it impossible to work effectively. Bootstrap countered that their concerns center on legitimate legal and compliance requirements that nonprofit organizations must respect.

Both sides likely have valid points. Balancing innovation with compliance, speed with legal caution, and business opportunity with nonprofit obligations creates genuine tensions without easy answers.

For Zcash users and supporters, the key takeaway is that the technology continues advancing, the network remains secure, and dedicated teams are still working to improve privacy-focused cryptocurrency. The organizational structure may be changing, but the mission continues.

As the cryptocurrency industry matures, governance disputes like this will probably become more common. How projects navigate these challenges—whether they emerge stronger or fractured—will separate sustainable projects from those that can’t adapt to growth and complexity. The Zcash community’s response to this challenge will be worth watching as a case study in crypto governance.